The $4.2M to $11.3M Masterclass – Lessons from 17 Manning Road Malvern East

Welcome to a special report on how to put together one of the best renovations I’ve seen in years.

No, this isn’t TV shows. There are no fake over-the-top reveals, borrowed emotion and false drama. Its all 100% real.

This is about smart decisions, long-term thinking, and the quiet confidence of people who knew what they were doing.

And let’s be clear — I don’t know these people. I’ve never met the owners, the architect, or the builder. I am simply an admirer of what has been achieved. I’ve walked through the home, seen it sold, and read/reworked here what’s publicly available.

These are my observations. If you’re thinking about a major renovation, there’s a lot you can learn from this one.

The People Behind It

The owner, Ben Cooper, isn’t your average renovator. He’s the Managing Director of Cameron Real Estate, one of Victoria’s largest commercial and industrial agencies. In short — he understands deals, structures, and timing. And it shows.

Learning #1: Your background matters. When you understand property as a business — not just a place to live — you make different decisions. Better decisions. Ben’s commercial real estate experience meant he could see past the emotion and focus on value creation.

What’s impressive here isn’t just that Ben and his family achieved a top-tier result — it’s how they did it. They didn’t knock down and start again. They read the home. They saw its bones, its orientation, its north-facing rear, and its inherent beauty. They didn’t get seduced by noise — they planned, consulted, and then quietly executed one of the best balanced renovations of a period home I have ever seen.

Learning #2: Sometimes the best move is restraint. The most expensive decision isn’t always the smartest one. Reading what’s already there and working with it — rather than against it — takes skill, patience, and confidence.

Ben’s words from his website: From successful business to truly professional real estate group. That’s the result of Ben Cooper’s leadership since becoming Cameron Managing Director in 2011.

And it’s easy to see why. With over 25 years in real estate Ben is a respected leader in the field. His passion for the industry and getting the best deal done guides the 1000-plus transactions Cameron performs each year. He loves nothing more than being at the coalface of a deal or negotiation, be it directly, or in support of his valued team.

Ben also serves the wider community by sitting on multiple boards, utilising his knowledge of real estate, business process, leadership and technology. Outside work, Ben immerses himself in his other passions; family, and cultivating his thoroughbred operation on the Mornington Peninsula.

Buy the Right Home to Begin With

The owners bought 17 Manning Road, Malvern East, in 2014 for $4.2 million.

This week, it sold for $11.3 million, with six bidders above $10 million.

That didn’t happen by accident.

The block was north-facing, flat, and beautifully proportioned, sitting in one of Melbourne’s most prestigious period precincts — the Gascoigne Estate. The original home had strong bones and good flow. The parking was tight, but everything else ticked the right boxes.

Learning #3: Start with the fundamentals. You can’t renovate your way out of poor position land. You can renovate your way out of a poor floorplan, but why start behind? You can’t renovate your way out of poor position land and floorplan at a smart price or time frame —you need to get all your PPPs right.

Position. Property. Price.

Learning #3a: Capital growth starts with what you buy, what you add and what you don’t.

Have a Clear Vision — and Don’t Get Pushed Around

From what I can see, the owners had a plan and stuck to it. They likely interviewed multiple architects and chose carefully. The result speaks volumes.

Learning #4: Not all architects are created equal — and not all collaborations work. Many people get led by architects and led right up the garden path. You can tell by the result this was a genuine collaboration of two parties who knew what they wanted and how to get it, and they got along. Great renovations happen with collaboration and synergy — YES I KNOW IT SOUNDS WANKY BUT IT’S TRUE.

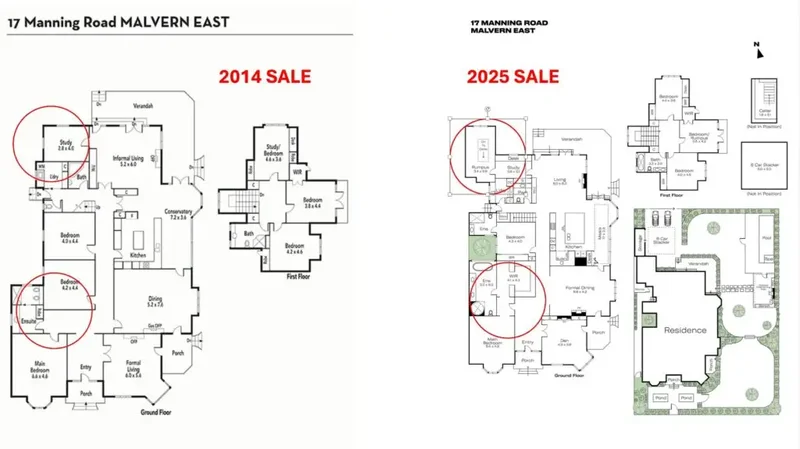

They went with Cera Stribley Architects, and their approach was restraint. The home was extended by just two rooms. They respected the existing and introducing modern where it mattered most — the kitchen, dining, and ensuite. Look at the side by side floor plans I have put together.

Learning #5: The genius wasn’t in the drama of change, but in the discipline of what they didn’t change. This is the hardest lesson to learn. This is so hard to be this classy.

Build with Precision and make sure you have a Grand Room – in this case they added 2 “Rare Grands”

Fortem Projects delivered the build — blending heritage with quiet precision.

They added many things but for me the 2 Grands 1) double car stacker, and 2) outdoor living zone.

Learning #6: Your builder is as important as your architect. A great design poorly executed is worth nothing. Fortem understood the brief — luxury without showing off, heritage without feeling dated, modern without jarring.

The project went on to win HIA and Master Builders Awards for best renovation, best kitchen, and best bathroom.

Finish with Landscape that Feels Like Living

Landscaping is too often an afterthought. Here, it completed the story.

Learning #7: Landscaping isn’t decoration — it’s integration. Get this wrong and even the best home feels disconnected. Get it right and the whole property lifts.

Learning #8: Light is currency. When your garden design floods the interior with natural light, you’re not just improving amenity — you’re adding value to every room in the house.

I loved the sanctuary of the whole of Manning Road – and outdoor complimented indoor.

Selling Campaign — From False Start to Record Result

When the owners of 17 Manning Road, Malvern East first launched their campaign, they entered a tough market in 2024. Despite the property’s quality, the initial attempt didn’t strike the right chord on price or, in my opinion, there were simply no $10m+ buyers there.

Learning #9: Timing isn’t everything, but it’s not nothing either. Even the best product can miss its moment. The key is knowing when to pause, recalibrate, and try again.

But rather than retreat, they believed in their product — they trusted the architectural integrity, the landscaping, and the position within the prestigious Gascoigne Estate — and they refocused, using the same strategy, but different agency/agent a year later: known agency but specialist out of area high-end agent — in this case Scott Patterson.

Learning #10: Back your own judgement. When you’ve done the work properly — bought well, planned well, executed beautifully — don’t panic when the market wobbles. Hold your nerve.

The result? Six serious bidders, offers topping the trigger of $10 million, and a final sale of $11.3 million.

- What Can We Learn?

If you take one thing away, it’s this: a great renovation isn’t about money — it’s about clarity.

- Buy the right home that matches your needs, can be “fixed’ and makes $ sense. Buy quality PPPs.

- Form a vision.

- Include a Grand Room or two like a view, a garden, a special oversized room or a garage if you are thinking of resale

- Hire people who understand class is not always with a bulldozer.

- And then stick fat to what you want – not move in the wind to others wants.

Renovations aren’t about doing everything. They’re about doing the right things — in the right order, for the right reasons.

This family bought well, planned well, and executed beautifully.

That’s how a $4.2 million purchase becomes an $11.3 million success story. As opposed to a $4.2 million purchase being knocked down and costing $11 million after building but selling for a false $8 million “unsuccess” story – and that is disguised by dinner party talk as “capital growth”.

If you’re thinking about your own version of this — not a copy, but your own calm, high-performing renovation — I’m happy to share what I’ve seen over the last 25+ years, what works, and what to watch for.

Well done to all involved and particularly to the owner Ben Cooper, you are one talented real estate human. Well done, my hats off to you!

Mal James 0408 107 988

- Sometimes I'm not sure and sometimes I say not yet!

When Walking Away from Fees Is the Right Thing to Do

As a real estate advocate, I sometimes turn down large commissions—$50K–$100K in potential fees—if it’s not in the client’s best interest. This means advising buyers they can do better elsewhere or sellers to stick with their current setup, even if it means rethinking their expectations.

A Recent Example: The $5–10M Property Dilemma

This week, owners of a high-end eastern suburbs home contacted me. They’d been on the market without success and now had an offer—just $200K–$300K below their target. They wanted my multi-agent, off-market strategy to restart the process.

The property is excellent, the owners lovely, and the fee tempting. But after reviewing, I advised: “You’ve likely met your buyer. Stick with your current agent and negotiate a deal.”

Why? The gap was bridgeable, and switching could delay things without guaranteeing more. They felt the buyer was lowballing; I explained buyers negotiate hard, just as sellers do. Friends had validated their price, but I framed “value” as a range, not a pinpoint number—shaped by emotions, comparables, and biases on all sides.

Key question I posed: “What do you really want—a specific number or a closed deal to move on with life?” Regrets could cut either way: rejecting and getting less later, or accepting and wondering if you left money on the table. Markets are unpredictable—2021 highs turned into 2025 regrets for some who held out.

Bridging the Gap: When Different Numbers Align

Deals can close even with mismatched figures. I’ve facilitated many where buyer and seller hold firm on their “values” but agree via creative terms (e.g., contingencies, adjustments). I encouraged them to explore this with their agent first.

The Challenges at This Level

High-end properties lack perfect comps; each is unique. Opinions dominate—sellers base value on needs and advice, buyers on willingness to pay. Add market volatility: Next year could bring more… or less.

Certainty is rare. If fixed on a number, that’s fine—but if the goal is progress, flexibility helps. Ask: What do I truly want, and what does that look like in dollars? Prioritise life goals over ego.

Why I Walked Away (For Now)

I couldn’t confidently add value without risking subtraction. They sought validation for switching; I provided honest uncertainty instead. If talks fail, I’d take the listing eagerly—it’s a strong property at a fair ask.

Outcome? Hopefully they’re negotiating further. If it closes, great—they avoid disruption. If not, we revisit. Either way, no regrets.

The Ethical Bottom Line

In real estate, “I don’t know” can be the best answer. Prioritising client needs over fees builds trust, even if it hurts short-term. Accountants might disagree, but it’s how I operate: Yes, no, or maybe—until maybe becomes clarity and that can be a yes or a no.

- There can be a solution when you are this close.

When Two Different Numbers become the same.

It’s possible to have two numbers that are different but the same. I’ve sorted through deals where the buyer has one number, the seller has another, AND they get a deal done where both numbers remain legitimate and different and both agree to a deal.

This is a puzzle for many, but it’s 100% true. Done it many times.

- Letterboxing this week for off-markets

- Do you have an off-market for any of our James Buyer Advocacy clients?

| PRICE | BUYER ADVOCACY | POSITION | PROPERTY |

| 3.5m | Brighton | Church St Precinct | Apartment |

| 1.8m | East Melbourne | Apartment | |

| 2m | Carnegie | to Richmond | Townhouse |

| 3.5m | Camberwell | Canterbury & Kew | New Home |

| 7m | Armadale – | Malvern Larger block and family home | Bigger yard, will reno |

| 6m | Camberwell Hawthorn | Camberwell Hawthorn | Renovation Value Add up to $2m |

| 1.2m | Caulfield | Anderson Park Area | Townhouse for single |

| 2m | Prahran | South Yarra, | Small home |

| 4.5m | Hawthorn | Malvern | Family Home |

| 3m | Surrey Hills, | Mont Albert Canterbury | Family Home |

| 3.2m | Mont Albert | Surrey Hills, Canterbury | Family Home |

- James Home Ratings GETS MARKET FEEDBACK

The James Home Rating System for Buyers

Three Ps. 1,000 points. A lifetime of difference.

Over the past 25 years, we’ve developed and refined one of Melbourne’s most trusted property assessment tools—

James Home Ratings. Built to bring science, structure, and strategy to high-stakes real estate decisions, it’s quietly helped more buyers and buy/sellers make more money than any other buyer advocate method in the city.

What Is It?

The James Home Rating is a 1,000-point scoring system based on the 3 critical drivers of long-term property value:

- Position – Street, precinct, orientation, land size, walkability, and school zones.

- Property – Building size, flow, floorplan, architecture, renovation quality, potential.

- Price – Relative value based on recent sales, market cycle timing, and agent positioning. Emotions

Each home is scored independently and consistently, based on how it aligns with long-term demand and supply fundamentals—not short-term trends or agent spin against other similar types of homes.

Why It Works – Patterns

Because real estate, at its core, is about human behaviour—and history repeats itself.

Over decades, we’ve tracked what buyers want, what they avoid, and where they pay premiums. Certain homes—especially true A-Graders—attract stronger demand in every market. Others, like C-Graders, only sell well in boom times.

Our 1,000-point system exposes where a home really sits in that cycle. That insight gives you:

- Confidence to buy strong,

- Courage to walk away from trouble, and

- Clarity to align your sell/buy strategy with your life goals.

A, B, C-Grade Homes – Know the Difference

- A-Grade: Always in demand. Rare, proven, and resilient through market shifts.

- B-Grade: Good, but situational. Can work well when bought or sold smartly.

- C-Grade: Riskier. More emotion-driven, often overhyped, and harder to recover value.

The James Home Rating makes these differences clear—before you commit.

What the Scores Mean

Here’s how the James Home Rating benchmarks property quality across inner Melbourne:

- 500 – Maybe ok but it has serious issues to consider

- 600 – Average: Typical for many Inner Melbourne homes

- 700 – Solid: Better than many, with clear buyer appeal

- 750–800 – Above Average: Strong fundamentals, few weaknesses

- 800+ – Exceptional: A-Grade, no obvious dealbreakers, rare and highly sought-after

Why It’s Made Clients Millions

Because clarity beats chaos. Whether you’re buying, selling, or doing both at once, the James Home Rating:

- Finds value others miss

- Exposes flaws hidden beneath polish

- Aligns your decision with long-term truth, not short-term noise

We’ve used it to protect clients, unlock better homes, and negotiate stronger outcomes—time and again for over 25 years – it is patented.

The James Home Rating System for Buy Sellers

Why the James Home Rating Works When You’re Selling

Science, structure, and serious clarity—for stronger decisions and better results.

Selling a home—especially in Melbourne’s inner suburbs—requires more than a good agent and some fresh paint. To get the best price from the best buyer, you first need to know what your home is truly worth, not just what an agent tells you.

That’s where the James Home Rating becomes a game-changer.

It’s Scientific. It’s Strategic. It’s Seller-Smart.

This isn’t guesswork or gut feel. Our 1,000-point scoring system is built around 3 core value pillars:

- Position – Location, street quality, orientation, amenity

- Property – Land size, architecture, layout flow, condition, scope

- Price – Based on real market dynamics and long-term performance

Each home is evaluated across a lot of PPP issues. From traffic noise to natural light, from ceiling heights to buyer emotion triggers—nothing is left out.

Why Sellers Use It

When you’re selling and planning to buy again, clarity is power.

The James Home Rating helps you:

- Understand your true market position before listing

- Avoid underquoting or overhyping, which can backfire

- Strategically align your sell/buy timing to minimise stress

- Pre-empt objections and improve buyer perception

- Back up your price expectations with logic—not hope

It’s not just for buyers—it’s a powerful tool for price-setting, deal-structuring, and agent accountability.

What the Scores Mean

Here’s how the James Home Rating benchmarks property quality across inner Melbourne:

- 500 – Maybe ok but it has serious issues to consider

- 600 – Average: Typical for many Inner Melbourne homes

- 700 – Solid: Better than many, with clear buyer appeal

- 750–800 – Above Average: Strong fundamentals, few weaknesses

- 800+ – Exceptional: A-Grade, no obvious dealbreakers, rare and highly sought-after

Bottom Line

The James Home Rating gives you what emotion and opinion can’t: a scientific, structured, and strategic understanding of your property.

Whether you’re buying, selling, or both, it’s the most powerful way to stay in control, avoid costly mistakes, and walk into every decision with confidence.

Clarity leads to stronger outcomes.

And stronger outcomes lead to better lives.

- OUR INSIGHTS BEFORE SALE

- WHAT THE MARKET SAID

Agent Mike Beardsley

EOI before

2 Bidders fought it out over a 24 hour period to just over $8,700,000. $1,200,000 over the top of the quote

James Insight: Great result for the builder developer for his quality and unique product and for the agent for his smart work.

Agents Daniel Bradd and Rae Tomlinson

Sold Before Auction when a $4,500,000 bid put it on the market. Wasn’t bettered.

James Insight: Solid result $400,000 over the top of the quote and top end of what we expected.

Agent: Mike Beardsley

Crowd: 30

Opening Bid: $2,250,000 vendor bid

Sold After: $2,470,000

Bidderman: 3

Glorious sunny day with the auctioneer making the most of tempting buyers to move in and enjoy such weather here. Bidding was predominantly in $10s and $5s with one continuously asking ‘is it on the market’.

James Insight: More bidders than expected for what was a difficult offering.

Auctioneer: Lachie Fraser-Smith

Crowd: 40

Opening Bid: $2,300,000

On the Market: $2,580,000

Under Hammer: $2,700,000 ($300,000 over quote)

Bidderman: 5

A bid to open came swiftly, interrupting the auctioneer’s final comments. Four bidders chugged along in $25s

until around $2,500,000 when bidding broke down to $5,000 rises but continued competitively nevertheless. A fifth bidder in,

on the market at $2,580,000 and on it continued with regular bids until a final call at $2,700,000.

Agents: Stuart Evans and Tim Mursell

Sold Before Auction over $3,300,000 and $600,000 over the quote.

James Insight: This was a great feeling house versus a home with a number of logical compromises. Feelings won out.

SOI: $2,500,000 – $2,700,000

Agent: Wesley Belt – Buxton

Crowd: 30

Opening Bid: $2,500,000 VB

Passed in: $2,550,000

Sold after: $2,740,000

Bidderman: 1

Despite the 30-odd crowd, after the initial vendor bid, only one bidder put their hand up, once; it wasn’t sufficient activity to fire up the crowd, resulting in the property being passed in. Jo

James Insight: Expected to be a tricky 1 bidder auction and was

Agent: Richard Winneke

Sold at auction with two bidders fighting it out—from on the market at $2.6 million and the top of the quote—to $3,335,000, or $735,000 over the quoted range.

James Insight. A lot stronger than expected

- Boroondara This Week

- Boroondara This Month

- Boroondara Recently Sold

- Bayside Port Phillip

- Bayside Port Phillip

- Bayside Port Phillip

- Stonnington This Week

- Stonnington This Month

- Stonnington Recently Sold

- Click Address through to Completed James Home Rating